Our list of Best Investment Banking Courses guides learners through valuation, M&A transactions, and financial modeling. You will develop crucial skills leading to a successful finance career.

Key Takeaways

- Learn all about the principles of valuation and financial analysis.

- A chance to build models for cash flow analysis, DCF valuation, and so much more.

- Through practical case studies and real-world examples, prepare for your exams.

What topics do investment banking courses cover?

These courses cover topics like financial modeling, M&A strategies, and valuation principles to help finance professionals understand how to handle complex transactions.

| # | Course Name | University/Organization | Ratings | Duration |

| 1. | Free Investment Banking Course with Certificate of Completion | WallStreetMojo | — | — |

| 2. | The Complete Investment Banking Course 2021 | Udemy | ★★★★★ 4.5 | 14 Hours |

| 3. | Investment Banking Course: Private Equity 101 | Udemy | ★★★★★ 4.5 | 09 Hours |

| 4. | Online Investment Banking Certification | New York Institute of Finance | — | 70 Hours |

| 5. | Investment Banking: Venture Capital Fund Raising Masterclass | Udemy | ★★★★★ 4.6 | 15 Hours |

| 6. | Investment Banking Training Courses | CFI | — | — |

| 7. | Advanced Accounting for Investment Banking | Udemy | ★★★★★ 4.7 | 04 Hours |

| 8. | Investment Banking Divisions Explained – For Students, Graduates and Professionals | SkillShare | — | 01 Hour |

| 9. | Venture Capital Financial Modeling | Udemy | ★★★★☆ 4.2 | — |

| 10. | Investment Banking: The Complete Financial Ratio Analysis | Udemy | ★★★★★ 4.7 | 05 Hours |

Investment Banking Courses Evaluation & Selection Criteria

We selected each course based on providing practical investment banking strategies, alignment with industry standards, and instructor expertise.

10 Best Investment Banking Courses

In this topic, we will be reviewing 10 Best Investment Banking Courses.

Free Investment Banking Course with Certificate of Completion [No more Available]

Free Investment Banking Course with Certificate of Completion [No more Available]

-

-

- via WallStreetMojo

- Course Type: Self-paced

- ★★★★★

-

From the list of Investment Banking Courses, This is a 3 step course. In the 1st step of the course, you will be needing to get access to the Part 1 Free Investment Banking Video Series. Moving into step 2, you will get to know about the details of these free courses, and in step 3, you will have the access to the different banking courses. Discover the top certifications recommended for 2024 in our detailed article on Banking Courses & Certifications.

In the 1st Part of the Investment Banking courses, you will be learning about investment Banking Overview. This course will let you know what is an Investment Bank, the various roles offered by Investment Banking, and you will know what IPO, M&A, Sell-Side, Buy-Side, etc is. Moreover, you will acquire all of the key skills required to enter into an Investment Bank.

Gain a deeper understanding of financial markets by mastering value investing strategies through specialized courses and training classes.

You will also get to know about Accounting. As the knowledge of accounting is a must. It is important to master the concepts of accounting. In this course, you’ll learn accounting in one hour without the necessity of using debits and credits. Undergo these Investment Banking courses thoroughly, even you’re a master in accounting.

Moving on to the other course From the Investment Banking Courses list which is the Calculator. In this course, you will cover the Texas Instruments calculator very helpful for performing critical calculations on the go.

The next course is a Basic Excel Course. In this course, you will follow a case study approach to teach you the basics of excel.

In the second part of the Investment Banking courses, the first course you will be looking forward to is Financial Modeling.

The second course is all about Ratio Analysis, moving on is the terminal value and a lot more.

The Complete Investment Banking Course 2021

The Complete Investment Banking Course 2021

-

-

- 365 Careers via Udemy

- 91,662+ already enrolled!

- ★★★★★ (21,094 Ratings)

-

| Online Course Effectiveness Score | |||

| Content | Engagement | Practice | Career Benefit |

| Excellent ★★★★★ |

Excellent ★★★★★ |

Fair ★★★☆☆ |

Fair ★★★☆☆ |

From the Best Investment Banking Courses list. This course by udemy, this course can help you land on a job as an investment banker. Now let us look at the things that you will be learning in this course.

Through this course, you can start a career in Investment Banking or Private Equity.

If you enroll for this course that is the top and best course of Investment Banking Courses List, you can construct monetary models without any preparation (demonstrated bit by bit), construct valuation models – DCF, LBO, and products. If you delve deeper into the course, you can have strong monetary and business insight, you can take your vocation to the following level, recount the narrative of how venture banking administrations originally showed up, comprehend the distinction among the speculation and business banking, and clarify the mechanics of an Initial Public Offering.

Now when you master and gain all of the information you will be able to see how valuing is resolved in an IPO, draw an IPO schedule, comprehend why organizations open up to the world, clarify the mechanics of a bond offering, see how evaluating is resolved in a bond offering, draw a bond offering plan, comprehend why organizations raise public obligation, clarify advance partnership and who partakes in the organization. Check out the the best wealth management courses.

This is a brilliant course from the top investment banking courses as it covers every aspect of Investment Banking, you can get securitization and clarify why banks use securitization, realize why organizations purchase different organizations, distinguish fruitful M&A exchanges, clarify the arrangement lifecycle, differentiate among Financial and Corporate purchasers, depict the diverse installment choices in an M&A bargain, and comprehend the substance of rebuilding administrations.

Also, there is no experience required in this course. You will start with the basics and gradually build up your knowledge. Everything is in the course. All you need is a willingness to learn and practice.

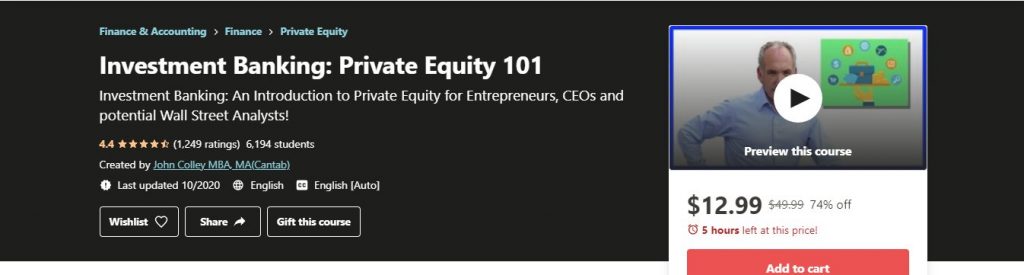

Investment Banking Course: Private Equity 101

-

-

- John Colley via Udemy

- 6,206+ already enrolled!

- ★★★★☆ (1,251 Ratings)

-

| Online Course Effectiveness Score | |||

| Content | Engagement | Practice | Career Benefit |

| Good ★★★★☆ |

Good ★★★★☆ |

Fair ★★★☆☆ |

Fair ★★★☆☆ |

This too is another course by udemy in which you can find the central ideas in Private Equity, a center Investment Banking ability needed by any Wall Street examiner, see how Private Equity Funds are raised and financed, comprehend what is implied by EBITDA and how to ascertain Finance Fundamentals, and increase an Investment Banking point of view on Value Creation in Private Equity contributing. As you go deeper into the classes, you can easily comprehend the distinction between a Leveraged Buyout (LBO) and a Management Buyout (MBO), find a Private Equity Business Strategy through a Categorization of Private Equity Firms, and comprehend the distinction between Private Equity and Venture Capital. In this course, the instructor will share with you his Banking and Finance viewpoint on Private Equity Deal Screening. You can also find out key skills for bank teller jobs.

Furthermore From Investment Banking Courses, get to learn how to comprehend the significance of Private Equity Firms’ Fund Lifecycle to Fund Raising, discover how the Private Equity Business gauges their outcomes, and acquires their pay, and understand a Private Equity Deal Funnel. So, join this course now to learn all of this.

Online Investment Banking Certification

Online Investment Banking Certification

-

-

- via New York Institute of Finance

- Course Type: Self-paced

- ★★★★★

-

The Investment Banking Certificate (IBC) may be a professional designation in 4 core disciplines in business and finance given by the New York Institute of Finance (NYIF). The IBC designation is an internet 70-hour program comprised of on-demand, self-paced learning. You may gain legitimately from industry specialists, market experts, and prepared account experts about business money, valuation, and venture banking.

The IBC program is meant at a graduate-level like a mini-MBA for a fraction of the value. Individuals awarded the IBC designation enhance their career opportunities by developing the essential, desk-ready skills associated with Capital Markets, Fund Management, Valuation, and Mergers and Acquisitions (M&A). Modules are often taken 100% online at your own pace and from anywhere within the world with a web connection.

Now let’s look at all of the things that you can learn through this course:

- Peruse and comprehend key components of economic summaries and reports, for example, monetary records, pay proclamations, and income explanations, just as how to apply fundamental money related and bookkeeping standards to spending readiness and investigation.

- Compare organizations monetarily, comprehend income, and handle fundamental productivity and danger investigation ideas.

- Understand the time estimation of cash, essential insights of examining and assessment, theory testing, likelihood circulation, connection and relapse methods, and time-arrangement investigation.

- Apply time estimation of cash standards, the capital planning structure, and examination of financing alternatives when settling on money related choices.

- Understand the basics of esteeming public and privately owned businesses.

- Have an outline of the significant features of the Mergers and Acquisitions industry and the aptitudes occupied with executing exchanges from the arrangement’s beginning to post-consolidation joining.

- Structure and arrangement from various points of view including basic to strange exchanges and gives a comprehension of the useful exchange structures for Mergers and Acquisitions and their monetary expense, legitimate and bookkeeping suggestions.

- Understand credit hazard, security rating frameworks, security exchanging phrasing, procedures and techniques, the yield bend and the elements that influence it, and the part of the Federal Reserve framework and its effect on securities.

Investment Banking: Venture Capital Fund Raising Masterclass

-

-

- John Colley via Udemy

- 2,100+ already enrolled!

- ★★★★★ (302 Ratings)

-

| Online Course Effectiveness Score | |||

| Content | Engagement | Practice | Career Benefit |

| Excellent ★★★★★ |

Good ★★★★☆ |

Fair ★★★☆☆ |

Fair ★★★☆☆ |

From the List Best Invetment Banking Courses In this course by udemy, you can Venture Capital Fundraising, Seed Fund Raising to Crowdfunding, Investor Pitching Venture Capital, and Angel Investors. Boost your career by taking one of these certificate courses in fundraising, designed to equip you with essential skills.

This course is the most Focused Udemy Course on Fundraising for Startups from Venture Capital. Through this course you can:

- Build up your comprehension of how Venture Capital ganders at Business, Finance and Startup Business Strategy and how this impacts their speculation measures: ensure you are conversing with the correct speculators

- The most effective method to email Venture Capital and Angel Investors

- Startup Fundraising from Angels and Venture Capital; locate the correct speculators, how to move toward them, how and how to dominate the craft of Investor Pitching

- The most effective method to clarify your Business Strategy and Finance necessities through your Business and Financial Plan. For those looking to enter the world of startup funding, check out our top VC training programs online.

- Step by step instructions to deal with the Fundraising Process

- Going past the Pitch Deck, comprehend Venture Capital Term Sheets and how to arrange them

- Find the capability of Equity Crowdfunding for your business and gain from a CEO how he effectively fund-raised for his Startup

- Essentially increment your odds of Fundraising from Venture Capital (and others) educated by an Investment Banker and Entrepreneur

To enroll for this course, you can access to Spreadsheet and Presentation software – Excel, Keynote, PowerPoint. You also need a determination to succeed despite the odds, and a commitment to following every step of this Investment Banking courses, there are no short cuts.

Investment Banking Training Courses

-

-

-

- via CFI

- Course Type: Self-paced

- ★★★★★

-

-

This is a platform where you can find multiple different types of courses related to Investment Banking Courses Training. The CFIU is the ultimate e-learning training for new investment banking analysts and associates.

New analysts hired into within the Investment Banking Division (IBD) of most investment banks are placed in an investment banking educational program to present them the talents they have to reach the work. These programs typically start within the summer and last about 6 weeks. Analysts are given the chance not only to develop their technical skills, but also opportunities to network and build relationships with colleagues across the bank. In some cases, analysts are also paired up with senior mentors to assist them to navigate through the first days of their careers.

These are the topics that will be covered in this intensive classroom-based training, typically at a global or regional location:

- Accounting fundamentals

- Financial statement analysis

- Financial modeling

- Corporate valuation

- Excel skills

- M&A transactions

- IPO process

- The bank’s products

In addition to full days on these core investment banking topics, IBD analysts also will attend lots of networking events to induce them to grasp their colleagues and navigate the bank’s social structures. Building relationships and networking along with your global IBD analyst class is additionally a key objective of this comprehensive educational program.

The CFI has a course catalog and the programs offered at most banks, including:

- Accounting fundamentals

- Financial statement analysis

- Financial modeling

- Corporate valuation

- Excel skills

- Corporate finance (M&A and Capital Raising)

- Mergers and acquisitions modeling

Advanced Accounting for Investment Banking

Advanced Accounting for Investment Banking

-

-

- Wall Street Prep via Udemy

- 1,440+ already enrolled!

- ★★★★★ (136 Ratings)

-

| Online Course Effectiveness Score | |||

| Content | Engagement | Practice | Career Benefit |

| Excellent ★★★★★ |

Excellent ★★★★★ |

Good ★★★★☆ |

Fair ★★★☆☆ |

From the List of Investment Banking Courses, In this course, you can frequently encounter investment banking accounting topics not covered in introductory courses.

In this course, you will be learning all sorts of different things such as Introduction, Stock-Based Compensation, Unusual or Infrequent Items, Non-GAAP Presentation on Financial Statements, and Normalizing Earnings Exercise. Furthermore, you will also be learning and practicing stuff such as deferred taxes, intercompany investments, and dept account.i.e. debt accounting, PIK, capitalized interest, OID, and OIP. You can also checkout best paying accounting jobs.

Investment Banking Divisions Explained – For Students, Graduates and Professionals [No more Available]

Investment Banking Divisions Explained – For Students, Graduates and Professionals [No more Available]

-

-

-

- Afzal Hussain via Skillshare

- 392+ already enrolled!

- ★★★★★ (23 Ratings)

-

-

| Online Course Effectiveness Score | |||

| Content | Engagement | Practice | Career Benefit |

| Good ★★★★☆ |

Good ★★★★☆ |

Fair ★★★☆☆ |

Fair ★★★☆☆ |

From Top and Best Investment Banking Courses, This is a course by skillshare. In this course, you will be given an overview and insight into the assorted divisions that form up a typical bulge bracket or global investment bank. The course covers everything you would like to understand so as to grasp the inner workings of an investment bank and approach your applications and interviews with investment banks with more confidence.

This Investment Banking Courses course aims to be easy to know and focuses on providing an entry-level understanding of every division without overwhelming the viewer with an excessive amount of information. As such, this course is for all levels no matter academic or work experience.

Upon completion of this course, your understanding will allow you to debate and explain the differences between divisions at length, each divisions’ function within the investment bank, and the way the various divisions work together so as to assist the investment bank succeed as a unit.

This class gives a clear insight into each division and their role and interactions with other decisions. I believe this class will be very useful for my future interviews (Qasim Mahmood).

Venture Capital Financial Modeling [No more Available]

-

-

- Institute of Investment Banking via Udemy

- 4,159+ already enrolled!

- ★★★★☆ (131 Ratings)

-

| Online Course Effectiveness Score | |||

| Content | Engagement | Practice | Career Benefit |

| Fair ★★★☆☆ |

Fair ★★★☆☆ |

Fair ★★★☆☆ |

Fair ★★★☆☆ |

Looking at this Investment Banking courses by udemy, this course has everything that you need to know and learn about to become an Investment Banker. Through this course, you can:

- Find out about investment, the requirement for gather pledges and contemplations on the brains of VC reserves

- Learn key kinds of plans of action seen in different investee organizations

- Learn through a contextual analysis with a theoretical investee organization and a VC firm

- Profound plunge into the money related model and bring out outright valuation numbers

- Work on exchange comps in dominate and talk about arrangement KPI

To enroll in these Investment Banking courses, all you need is a computer with an internet connection, a passion for learning, and basic knowledge of finance.

Investment Banking: The Complete Financial Ratio Analysis

Investment Banking: The Complete Financial Ratio Analysis

-

-

-

-

- Wealthy Education via Udemy

- 2,158+ already enrolled!

- ★★★★☆ (297 Ratings)

-

-

-

| Online Course Effectiveness Score | |||

| Content | Engagement | Practice | Career Benefit |

| Excellent ★★★★★ |

Good ★★★★☆ |

Fair ★★★☆☆ |

Fair ★★★☆☆ |

In this professional Investment banking courses by udemy, you get to know how to Perform Financial Statement Analysis and Company Valuation. Let us have a look at all of the different things that you will be learning in this course that stands in the Top 10 Investment Banking Courses:

- How to Measure a Company’s Liquidity

- Current Ratio Analysis

- Quick Ratio Analysis

- Cash Ratio Analysis

- How to Measure a Company’s Solvency

- Debt to Equity Ratio Analysis (D/E)

- Debt to Asset Ratio Analysis (D/A)

- Working Capital to Debt Ratio Analysis (WC/D)

- Debt Service Coverage Ratio Analysis (DSCR)

- Times Interest Earned Ratio Analysis (TIE)

- How to Measure a Company’s Efficiency

- Inventory Turnover Ratio Analysis

- Average Inventory Processing Period Analysis

- Accounts Receivable Turnover Ratio Analysis

- Average Collection Period Analysis

- Accounts Payable Turnover Ratio Analysis

- Average Payment Period Analysis

- How to Measure a Company’s Profitability

- Gross Profit Margin Ratio Analysis (GPM)

- Operating Profit Margin Ratio Analysis (OPM)

- Net Profit Margin Ratio Analysis (NPM)

And a lot more.

Conclusion:

So, these were the 10 Best Investment Banking Courses. You can choose whatever course suits you. Stay safe and keep learning.