- Who is a Financial Analyst?

- Key Job Responsibilities of Financial Analyst

- Required Qualification/Education

- What makes you qualified for this job?

- Top Companies/Organizations Hiring Financial Analyst

- Financial Analyst Salary Statistics

Who is a Financial Analyst?

A financial analyst is an individual who has to analyze the past and present financial data of the organization he works for. He has to estimate future revenues and expenditures. Similarly, he is the one who has to predict the return on investment for different stocks and business ventures and write financial reports effectively. This individual is responsible for collecting industry research for decision-making.

Typically, you will find financial analysts working at banks, consulting firms, mutual funds, and corporations where they have to work together and generate wise investment strategies. The financial analyst also has to support overall financial growth and stability and even report to a supervisor or manager. Before entering this position, a financial analyst may require experience working in the finance or investment banking sector.

This article is all about explaining who a financial analyst is, what he does, the skills required, and other relevant details.

Key Responsibilities of a Financial Analyst

A financial analyst juggles multiple tasks at the same time and below we have listed some of the major key responsibilities.

- Analyzes the financial data and make sure to provide necessary forecasting support.

- Oversees all kinds of financial functions like assessing, auditing, budgeting, planning, and more.

- Manages taxes, consolidation, cost control, and project control as well.

- Organizes the entire data in the form of accessible reports. Performs various types of analysis using key metrics like yearly growth, return on equity, return on asset, and earnings per share.

- Reviews all the non-legal pertinent information about prospective deals.

- Evaluates and analyzes capital expenditures, depreciation, investment opportunities, and proposals.

- Takes care of the profit plans, operating records, and financial statements.

- Studies a company’s financial data and give advice for guiding business investments and overall financial strategy.

- Identifies trends in financial performance and offer recommendations for improvement.

- Coordinates with other members of the finance teams and review financial information.

Are you ready for your 2024 CFA Exam Preparation journey? Check out our expert tips and resources.

Required Qualification/Education

- To become a financial analyst, you’d typically need a bachelor’s degree in either business administration or a relevant field.

- A master’s degree in a relevant field can also be of great help in advancing your career.

Don’t miss out on our detailed Financial Analysis Courses & Classes to elevate your career.

Recommended Courses:

Finance & Quantitative Modeling for Analysts Specialization

Finance & Quantitative Modeling for Analysts Specialization- University of Pennsylvania via Coursera

- 25,469+ already enrolled!

- ★★★★★ (2,304 Ratings)

The Complete Financial Analyst Training & Investing Course

The Complete Financial Analyst Training & Investing Course

- Chris Haroun via Udemy

- 242,202+ already enrolled!

- ★★★★★ (29,538 Ratings)

Financial Analysis Courses – Expert Track for Business Decisions

Financial Analysis Courses – Expert Track for Business Decisions

- Coventry University via FutureLearn

- Study Level: Introductory

- 48 Hours of effort required!

What makes you qualified for this job?

There are some skills that we believe can help financial analysts perform well at their job place. Below, we have narrowed down some of the most relevant hard and soft skills.

Hard Skills:

- A good know-how of how to do quantitative analysis is helpful.

- You should know various financial market forecasting techniques.

- Similarly, you should have computing abilities.

- Knowledge of Sarbanes-Oxley can add value to your work.

- Next, familiarity with financial programs and software is also helpful.

- A basic understanding of financial principles is important to possess.

Soft Skills:

- Project management skills are important to possess.

- A financial analyst should be good at communicating with the team members.

- He should possess problem-solving skills.

- Having the ability to multitask is important.

- Good time management and organizational skills are required.

- The ability to think strategically is important.

- Good presentation skills are required.

- Leadership skills are also important to possess.

In-Demand Certifications

Even though a proper degree, skills, and enough experience can add value to one’s career and help him reach new heights of success. Yet there are other ways to help you make a good career in finance. This is by earning a certification. Below we have mentioned some certifications that can help you in this case.

Top Companies/Organizations Hiring Financial Analyst

Overall, the demand for financial analysts typically increases with the overall economic activity. Financial analysts play an important part in evaluating investment opportunities whenever new businesses are established. They also play an important part in expanding existing businesses. They are also required to help their employers make the best investing decisions. They usually do that by identifying trends in financial data that they extrapolate into making future business predictions.

Top companies like Amazon, JPMorgan Chase & Co, Wells Fargo, Bank of America, Lockheed Martin, Boeing, Goldman Sachs, and many others are actively hiring financial analysts to join the team.

Financial analysts can work in industries like investment banks, insurance, government, business, venture capital firms, and others.

Therefore, given the value of this role, a financial analyst is a great career option and compared to other high-paying careers, it is much less rigid and well-defined. Not just that, the overall job satisfaction for financial analysts is above average which gives individuals no reason to not pursue this career.

Financial Analyst Salary Statistics

This section contains salary statistics of a financial analyst working in different major countries.

| Country | Average Salary (Yearly) |

| United States | $87,087 |

| Canada | CA$74,013 |

| United Kingdom | £46,924 |

| India | ₹615,000 |

| Australia | A$98,000 |

USA:

The average annual salary of a financial analyst working in the United States can expect to make an average annual salary of $87,087.

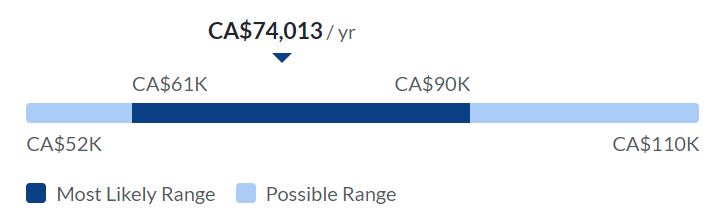

Canada:

In Canada, financial analysts can expect to earn an average annual salary of CA$74,013.

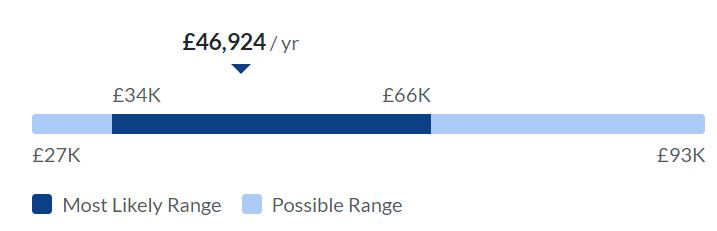

UK:

If you are working in England as a financial analyst then your average annual salary should be around £46,924.

India:

The average annual salary of a financial analyst working in India is around ₹615,000.

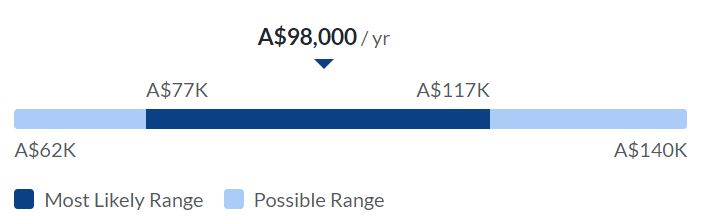

Australia:

A financial analyst working in Australia generally makes an average annual salary of A$98,000.

References/Sources:

- https://www.glassdoor.com/

- https://www.indeed.com/

- Please note that mentioned salary stats are as of September, 2023.